The overwhelming success that Overstock.com has received since accepting bitcoin payments earlier this year has prompted the online retailer to start allowing international customers to pay with the virtual currency.

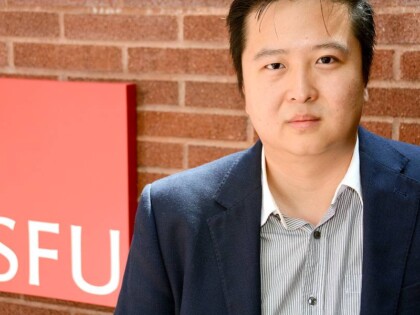

Speaking in an interview with Russia Today, Overstock.com CEO Patrick Byrne released some important information regarding the company’s immediate plans. He revealed that the website will enable bitcoin payments for global clients within the next month to six weeks, a major announcement for those who wish to purchase their items with the digital currency.

Overstock.com sped up the process because of the exorbitant media attention and the amount of revenues that the company has garnered over the past seven months. This will also give the company an edge over its competitors because it’ll be one of the first merchants to integrate a global bitcoin clientele.

In addition to accepting bitcoins, Overstock.com maintains a small percentage of bitcoins and the digital holdings are placed in its reserves.

The peer-to-peer decentralized virtual currency has had a rollercoaster of the year. Although it experienced a major setback because of the bankruptcy of the biggest bitcoin exchange website in the world, a growing number of major retailers have adopted bitcoin, including Expedia, CheapAir, the Dish Network, the Sacramento Kings and TigerDirect.

Byrne is an avid cryptocurrency aficionado, who thinks the United States is a doomed currency. The head of Overstock.com spoke with The Blaze’s Glenn Beck and discussed an array of political matters, including the Federal Reserve System. He even believes that innovations like bitcoin can prevent the U.S. from entering another recession.

“The history of this country can be told as a history of two competing power centers: Wall Street and Washington,” Byrne said in an interview with Beck last week. “What’s happened in recent decades is, Wall Street has gotten Washington under its thumb. That’s where republics go to die. We’re becoming an oligarchy.”

Citing economists Thomas Sowell and Milton Friedman as two of heroes because they have both lambasted the central bank – Friedman was an advocate of the Fed during the 1970s and 1980s but began to condemn the system later on in his life – Byrne thinks the Fed needs to be abolished.

“The Federal Reserve is like a tumor in America,” Byrne said. “You cut it out. You don’t replace it with anything.”

If there is one thing the bitcoin community has in common is its disdain of the current system in place in the U.S. and how the Fed has destroyed the U.S. dollar by devaluing its currency by 90 percent since its inception in 1913.