Yesterday the Euro Banking Association (EBA), a conglomerate of over 200 banks and financial organizations from within the European Union, published a paper titled “Cryptotechnologies, a major IT innovation and catalyst for change”.

More specifically, the paper was produced by the EBA Working Group on Electronic and Alternative Payments, a body created by EBA after the dissolution of the Cash Displacement Working Group in 2013 (as its name indicated, the group’s studies were centered on technologies that could displace the use of cash) when they chose to focus their efforts on the future of electronic payments.

Below are the highlights of the 25 page paper, which focuses on the practical applications of cryptotechnology in the short to medium term with an emphasis on banking and payments processing:

“Over the past five years, cryptotechnologies have surfaced as major IT innovation with the potential to improve the architecture of systems and processes in a number of digital transaction-based industries. At the core of this invention is the concept of ‘distributed consensus ledgers.’ These ledgers make it posible to jointly create, evolve and keep track of one repository of transactions or other successive events over ashared network (documenting, for instance, the ownership of value) without maintenance or administration by a central authority”

“Until now, the most salient manifestation of cryptotechnologies has been Bitcoin as a ‘cryptocurrency’ application”

After a brief introduction the paper makes mention of how several regulatory bodies are reacting to crypto currencies, the publication of other reports and the proposed regulation by FinCen in the USA, although in their opinion crypto technology is still in its nascent phase, which is to say a lack of proper regulation or delay in recognition is to be expected.

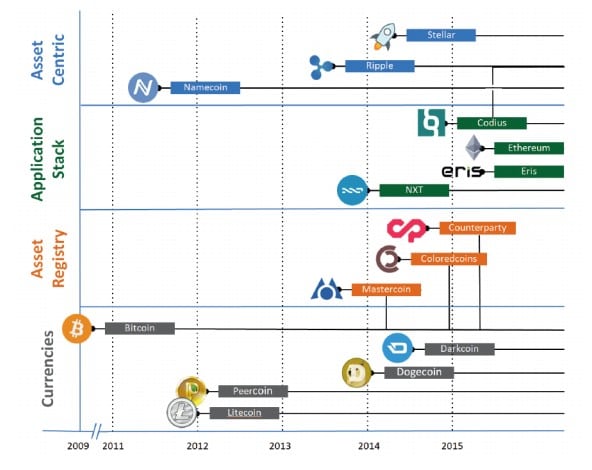

“For the benefit of the transaction banking and payments industry, an analysis of the current application landscape has been conducted as a basis for the present paper. In this context, the categorization of cryptotechnology-related applications into ‘currencies’, ‘asset registry’, ‘application stack’ and ‘asset-centric technology’ has been considered particularly helpful (although other categorisations exist).”

In regards to the currency classification:

“The innovative nature of these applications do provide consumers with certain functions that address key consumer and merchant requirements, namely with regard to reach, conversion and cost. This is reflected in the growing rate of interest and usage these applications enjoy among consumers and merchants globally across multiple channels while their relative market penetration till remains very small.”

“Different jurisdictions currently interpret ‘cryptocurrencies’ in different ways, but draw the same conclusion. The conclusion is that they do not pass the test to become legitimate fiat currencies and do not offer to consumers the same rights and protections of conventional fiat currencies”

On the topic of asset registry:

“Asset registries use public ledgers to register assets other than the ‘coins’ these public ledgers use.”

“The owner of the private key to that public record is then the owner of that asset. Asset registries have a potential for reduction of governance and auditing cost.”

When discussing “application stacks”:

“The main focus of any application stack is on becoming a platform for the development and execution of complete applications on top of decentralized networks.”

“…to date, this technology is perceived as immature for banking grade applications and some of these much anticipated applications have not yet been launched.”

On “asset-centric” assets:

“Asset-centric technologies enable novel efficiencies (e.g. real-time processes) in different areas, such as foreign exchange/remittances, documentary trade, inter-PSP transactions and asset servicing. Innovative vendors are currently developing software that they market as supporting banks and other organizations in leveraging the opportunities for cost reduction, better products and faster time to market that come with reaping these efficiencies.”

“Foreign exchange (Forex) transactions and remittances can be improved in terms of speed and efficiency through asset-centric cryptotechnologies, potentially forming an alternative for today’s involvement of the various PSPs and clearing and settlement mechanisms.”

“Today‘s documentary tasks could be further automated with the support of cryptotechnologies. This could be realized through distinct features of cryptography, such as multi-signature wallets and full end-to-end process transparency for all participants (PSPs, vendor, customer). The automation of the process around a ‘conditional’ payment could be taken to the next level, and related oversight and security costs could be reduced further.”

Further on the paper moves to discussing the possible scenarios of cryptotechnology adoption regarding the banking industry:

“Due to the interest from the international software development community, venture capital funding and the broad set of possibilities that distributed consensus ledgers offer, cryptotechnologies are by no means just a passing trend.”

“…the successful implementation of cryptotechnologies is also dependent on outcomes that are more achievable on a cooperative, inter-PSP basis. For instance, a critical mass of participating banks would be needed to ensure interoperability. The requisite amount of market makers and processing power providers are needed to provide liquidity and ensure the scalability of the ledger.”

“Another type of cooperation, the cooperation between the cryptotechnology community and banks,will not only influence the success of one cryptotechnology implementation but will impact the very level of innovation of cryptotechnologies that PSPs will have access to.”

The four scenarios as outlined by the Working Group on Electronic Alternative Payments are as follows:

- The creation of a separate cryptoeconomy due to lack of cooperation and adoption by payment service providers and crypto developers.

- A situation in which infighting between PSPs prevents collaboration and thus end up individually trying to “reinvent the wheel” and ignore recent developments.

- A scenario in which PSPs and the crypto community collaborate together and develop partnerships in selective areas.

- Full adoption from PSPs regarding the crypto community and the integration of existing processes.

In conclusion, according to the WGEAP:

“Currently, asset-centric developments are potentially the most interesting cryptotechnology-related category for transaction banking and the payments industry. This conclusion has been drawn based on the fact that developments in other areas are still impeded by technological and regulatory challenges, even though these other categories also hold considerable future promise.”

“Cryptotechnologies are still a nascent area of innovation. Together with emerging and future technical developments in this area, the impact (and speed of impact) of cryptotechnologies on the transaction and payments industry will very much depend on the future cooperation models as well as the adoption of cryptotechnology-fuelled applications by existing or new market players. What can be safely said at this point in time is that cryptotechnologies are an area to be closely monitored and revisited for further analysis.”

You can read find the full paper here in PDF format.